Getting quotes and proposals out the door quickly and, more importantly, accurately is no easy feat. Between all the moving parts, tricksy compliance requirements, and constantly changing product details, the quoting process can quickly become a real headache.

Even one tiny mistake can cause huge issues in the finance industry. That misplaced decimal might seem innocent, but it could snowball into something much, much bigger and costlier.

This is where CPQ (Configure, Price, Quote) solutions come in handy. They automate your quote creation process for even the most complex product configurations—which, let’s face it, are incredibly common in this sector.

Here’s a rundown of the most popular CPQ use cases in finance and how it can benefit your business.

4 Top Use Cases for CPQ in Financial Services

The finance sector comes with a ton of red tape—which is why a CPQ tool can come in very, very useful (and, in many cases, absolutely necessary).

1. Simplify How You Configure Complex Products

Financial products are often complex because clients want solutions tailored specifically to their wants and needs—think things like a unique insurance plan or a custom investment package.

But manually handling these configurations gets riskier the more sophisticated they get. It’s easy for details to get lost in a back-and-forth with sales, product, and compliance teams, which is where CPQ comes into play.

CPQ automates all of this so you can create precise, customized configurations in seconds. Instead of digging through spreadsheets or relying on manual calculations, your team can quickly build products that meet the needs of each specific client.

2. Keep Quotes Error-Free and Accurate

Creating finance quotes manually is nothing short of a total minefield.

One tiny error, like a typo or an incorrect calculation, can get out of hand very quickly. It leaves way too much room for human error, especially when you’re working with complex or custom products.

CPQ reduces the risk of human error because it automates the entire quote generation process—all your team has to do is input the data and the system handles all the heavy lifting. There’s a secondary benefit from this too. It frees up your sales team to focus on connecting with clients and actually closing deals.

3. Speed Up Sales and Approvals

Lengthy approval processes can be the kiss of death for deals.

There’s a good chance your team is getting bogged down in layers of approvals and manual checks before you even have the chance to send a quote to a client.

With CPQ, the whole approval workflow is considerably faster (and smoother). Quotes are pushed automatically through each stage and any issues are flagged right away, pulling in the right decision-makers only when they’re absolutely needed. This tends to mean faster deal cycles and a happier client on the other end.

4. Stay Compliant

Compliance isn’t optional in the finance industry.

From data privacy laws to industry-specific regulations, you have to make sure your quotes are compliant with any external rules and internal policies.

But obviously keeping track of these can be a huge headache if you’re doing it all manually.

Financial Services CPQ offers a built-in layer of compliance by baking all your internal policies and regulatory requirements directly into the quoting process. It checks each configuration against the latest standards so every quote is compliant and standardized.

The Major Benefits of Implementing Financial Services CPQ

CPQ’s ability to automate approvals, speed up sales, and deliver error-free quotes quickly are just a few of the key benefits.

Better Accuracy and Less Human Error

CPQ solutions dramatically reduce your margin of error by automating calculations, configurations, and the entire quoting process. It makes sure every quote is precise and consistent, regardless of how complex the product is.

Improved Customer Experience

Accuracy and speed are core foundations in finance—no one wants to feel like their money or financial situation is hanging in the balance.

Waiting days or even weeks for a quote (or worse, getting one riddled with errors) doesn’t exactly build trust.

But with a CPQ, you can send accurate quotes in an instant. Clients aren’t left waiting and your team can give clear, confident answers in real-time. And, since CPQ keeps every quote consistent with current data and policies, clients know they’re getting an offer that’s fair and tailored to their needs.

Scalability and Flexibility

The finance industry is constantly in flux.

You probably update your services frequently and are often left to keep up with changing client expectations—and then you have to make sure quotes are consistent. It’s a struggle, especially if you’re using legacy systems that can’t keep up with these demands.

CPQs are scalable and flexible. When new products or changes come into play, CPQ adapts right along with them. This lets your team quickly incorporate updates without missing a beat. Plus, CPQ grows with you, whether that’s expanding into new regions or handling a sudden increase in demand.

Challenges and Solutions for CPQ Implementation in Finance

One of the biggest challenges you might face with CPQ is integrating it with existing legacy systems. Lots of finance companies have complex tech stacks that include a mix of custom-built software, aging databases, and third-party tools.

Trying to shoehorn a new CPQ solution into the mix can feel… well, not great. Legacy systems weren’t really built with today’s digital tools in mind and this is highlighted when you’re trying to integrate it with something like a CPQ solution.

The result is Frankenstein’s monster of a tech stack that ultimately creates data silos, slows down processes, and leads to inconsistent info (which completely defeats the purpose of adopting a CPQ in the first place).

Here are some tips for successfully implementing a CPQ system.

- Start with a plan. Work with your IT team and CPQ provider to map out where and how the CPQ tool will interact with your current systems.

- Prioritize clean data. Before going live, make sure all your customer, product, and pricing data is accurate and up-to-date. You might need to run a thorough data audit or work with specific departments to clear up anything unclear.

- Get key stakeholders involved early. Involve reps from your core depts (sales, finance, IT, and compliance, at the bare minimum). Understand their needs, identify potential roadblocks and, most importantly, get their buy-in.

- Focus on change management and training. Host in-depth training sessions for users, provide easy access to resources, and encourage open communication about any potential issues. You might also consider ongoing support, like refresher courses or quick-access documentation.

- Always be testing. Treat CPQ implementation as an ongoing process (because it is). Monitor how it’s performing and listen to feedback from your team. Check metrics like quote accuracy, approval time, and client satisfaction to see if the CPQ tool is meeting your goals.

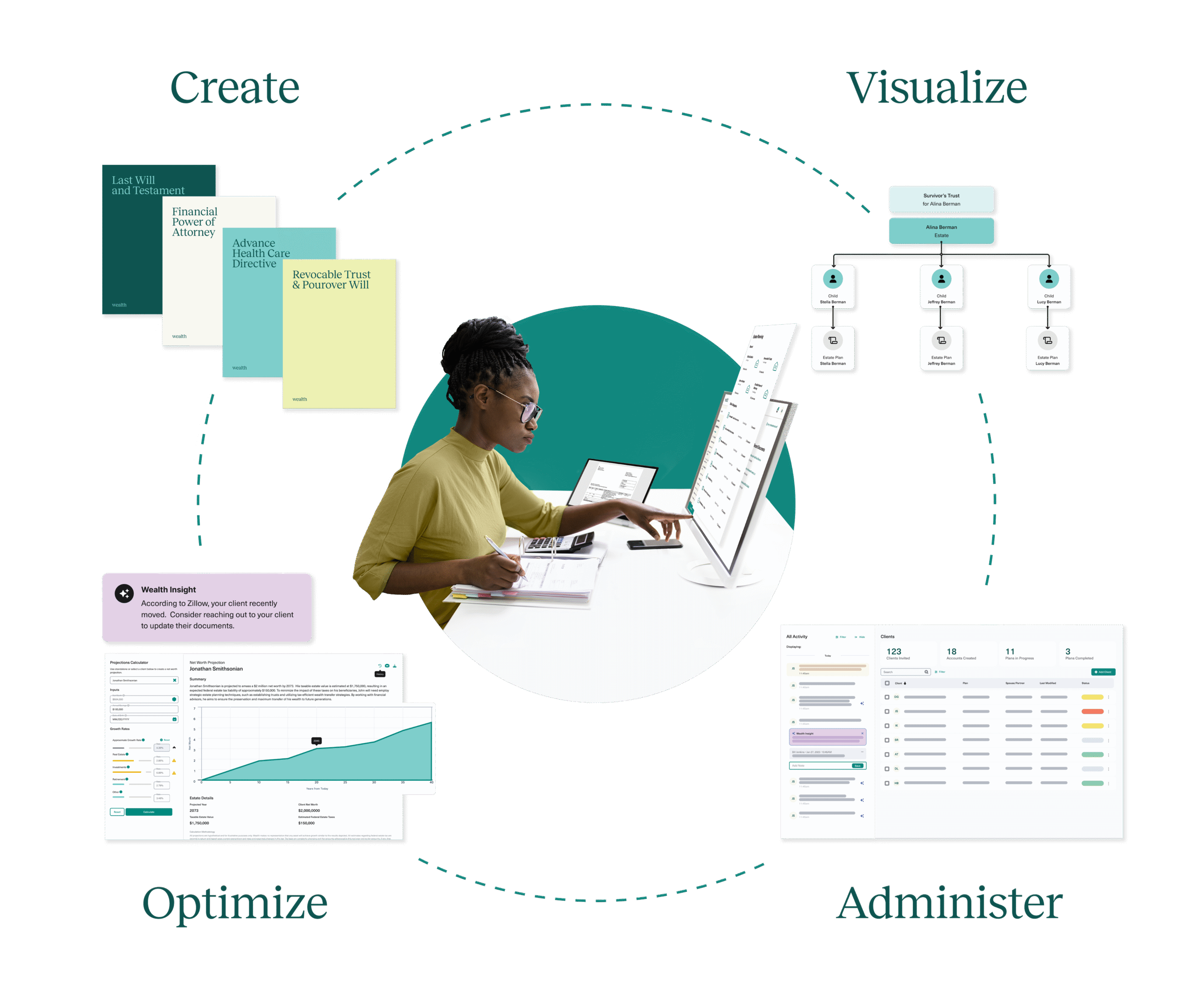

Example: Wealth.com, an AI-driven estate planning platform for financial advisors, reduced quote turnaround time by 60% and achieved 100% team adoption with a CPQ solution powered by LeanScale and DealHub. Their fast, six-week implementation streamlined approvals, eliminated manual errors, and delivered quotes to advisors faster than ever—boosting both efficiency and customer satisfaction.

3 Key Metrics to Monitor Post-Implementation

Once your CPQ is up and running, it’s important to measure its success. This means tracking the right key performance indicators (KPIs).

Here’s what to keep an eye on.

1. Reduced Quote Time

One of the biggest wins with CPQ is a faster quoting process.

With CPQ automating many time-consuming tasks, your team should be able to generate quotes in a fraction of the time it used to take.

Set a benchmark for how long quotes used to take and compare that with what your numbers look like *post-*implementation. Ideally, you’ll see a steady decrease in time spent per quote.

2. Increased Proposal Accuracy

A good CPQ system eliminates most human errors by automating calculations and making sure you’re compliant with pricing rules.

To measure this metric, track the number of errors or adjustments needed on quotes and proposals before and after you’ve implemented the CPQ tool.

You should see an immediate drop in revisions after you’ve implemented the tool.

3. Faster Approval Rates

The built-in workflows in a CPQ tool move quotes through your approval pipeline, so there should be far fewer bottlenecks and delays.

Monitor how long it takes for a proposal to go from creation to final approval and look for a reduction after you’ve implemented your CPQ.

Take the Headache Out of Quoting with CPQ Solutions

Between client demands for personalized products, strict compliance rules, and the risks of human error, it’s easy for quotes to become a niggly bottleneck that slows down sales and frustrates clients.

But, with a Financial Services CPQ solution, you can automate complex configurations and deliver accurate quotes on time, every time.

In this sector, CPQ is more than just a “nice to have”. It protects your reputation, reduces manual work, and makes sure clients get precise, prompt service.

If you’re considering CPQ for your financial services team, start by defining your goals, rallying your stakeholders, and finding a CPQ partner who understands the unique challenges of the finance sector.

Ready to streamline your quoting process? Explore how Experlogix’s tailored CPQ solutions for finance can help you make the leap.